Target RedCard: How It Works and How to Use It to Save at Target

Target is a fun store to shop at, but it can get expensive with all the irresistible products they carry. Thankfully, Target offers its shoppers options like the RedCard to save money each time they visit the store or order online.

RedCard is a credit or debit card used in Target stores or online. The main benefit of RedCard is the 5% discount on eligible purchases. You can apply for a Target RedCard in-store or online and start using it immediately once approved. While you cannot use your RedCard with Apple Pay or Google Pay, it can be used with Target Wallet.

In this article, we’ll cover what you need to know about saving at Target with the RedCard, including how to apply and use your RedCard.

Have you heard of the REDcard? 👀

— Target (@Target) January 29, 2019

How Does Target RedCard Work?

Target RedCard is a credit or debit card used for purchases at Target. The credit card offers a line of credit through TD Bank USA, while the debit card is directly connected to your checking account. There is no annual fee for the Target RedCard, and it offers many benefits, including a 5% discount on eligible purchases.

When you sign up for a Target RedCard credit card, you will not have any upfront or annual fees to pay. And if you pay off your balances on time, you shouldn’t encounter any surprising fees.

However, the credit card has a 22.9% interest rate for balances not paid by their due date.

There are also fees for late or returned payments for the Target RedCard credit card.

A late payment can incur up to $40 in late fees. In addition, if your payment is returned, you could be charged up to $29.

The Target RedCard debit card also has a returned payment fee. Depending on where you live, you can be charged up to $40 for a returned payment.

You shouldn’t encounter any extra fees if you ensure there are enough funds in your checking account to cover any purchase you make with the RedCard debit card.

Not only can you use your RedCard to earn the 5% discount on regular purchases, but you can also use it at the Target Starbucks locations.

The Target RedCard also earns a 5% discount on Clearance items, specialty gift cards, Drive Up orders, and delivery orders through Shipt.

#Freeshipping should be, well, free. Apply for a REDcard. No annual fees. See http://t.co/vBko7RECFA for details. pic.twitter.com/2dKcN2ZWmB

— Target (@Target) May 15, 2015

What Are the Benefits of Target RedCard?

Target RedCard offers many benefits, including a 5% discount, extra time for returns, and free shipping on online orders. It also has no annual fee. If you sign up during a special promotion, you can get a bonus reward when you register for the RedCard. There are a few differences between RedCard credit cards and debit cards.

There are many similarities between the Target RedCard credit card and the debit card. For example, they both earn a 5% discount on eligible purchases.

Customers also can get free shipping on online orders, including two-day shipping for most items, when they pay with a credit or debit RedCard.

Those with a RedCard also get access to exclusive items and offers.

The Target RedCard debit card also allows users to withdraw up to $40 in cash along with their purchase.

However, the credit card does not allow customers a similar benefit to a cash advance.

You should be aware of the “fine print” details for some of these benefits. For example, the 5% RedCard discount does not apply to every single item sold at Target.

Items and services purchased from the pharmacy or Target Optical are not eligible for the 5% RedCard discount. In addition, gift card purchases are also not eligible.

Finally, the 5% RedCard discount does not apply to taxes, shipping/handling fees, and other fees such as the Shipt membership payment.

Here is a comparison of the Target RedCard Credit Card and the Debit card:

| Benefits | Target RedCard Credit Card | Target RedCard Debit Card |

| 5% Discount | Yes | Yes |

| No Annual Fee | Yes | Yes |

| Free Shipping on Online Orders | Yes | Yes |

| Free 2-Day Shipping | Yes | Yes |

| Exclusive Items and Offers | Yes | Yes |

| Additional 30 Days for Returns | Yes | Yes |

| Withdraw up to $40 Cash | No | Yes |

Great question! You can apply for a RedCard in store or online at https://t.co/2S77Lv6iON. Please let us know if you have any other questions!

— AskTarget (@AskTarget) July 8, 2021

How to Apply for Target RedCard

To apply for a Target RedCard, you must provide your contact information and verify your identity. The RedCard credit card application also requires information about your annual income. The RedCard debit card application has options to verify your personal checking account is valid and active before approval.

It is easy to apply for a Target RedCard online. To help you further, we outlined the process for applying for a RedCard credit card and a debit card below.

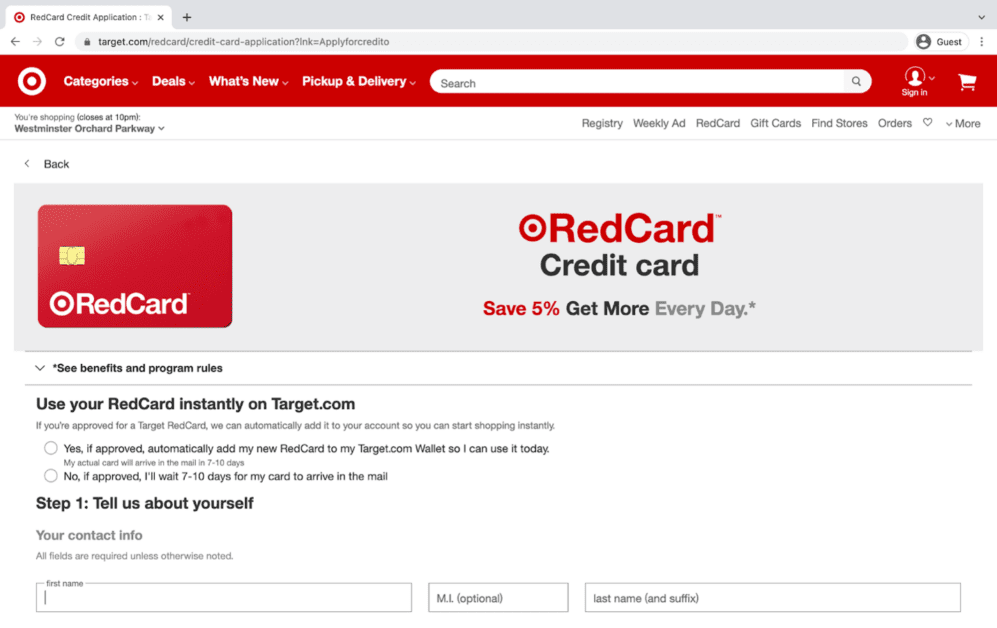

Here is a step-by-step guide to applying for a Target RedCard credit card:

1. Choose whether you want to instantly access your card via the Target Wallet or wait for the physical card to arrive.

2. Provide contact information. This includes your name, phone number, email address, and home address.

3. Verify your identity and annual income. You will need to enter your birthday, ID information, social security number, and gross annual income.

4. Create a PIN.

5. Submit your application and wait for the approval.

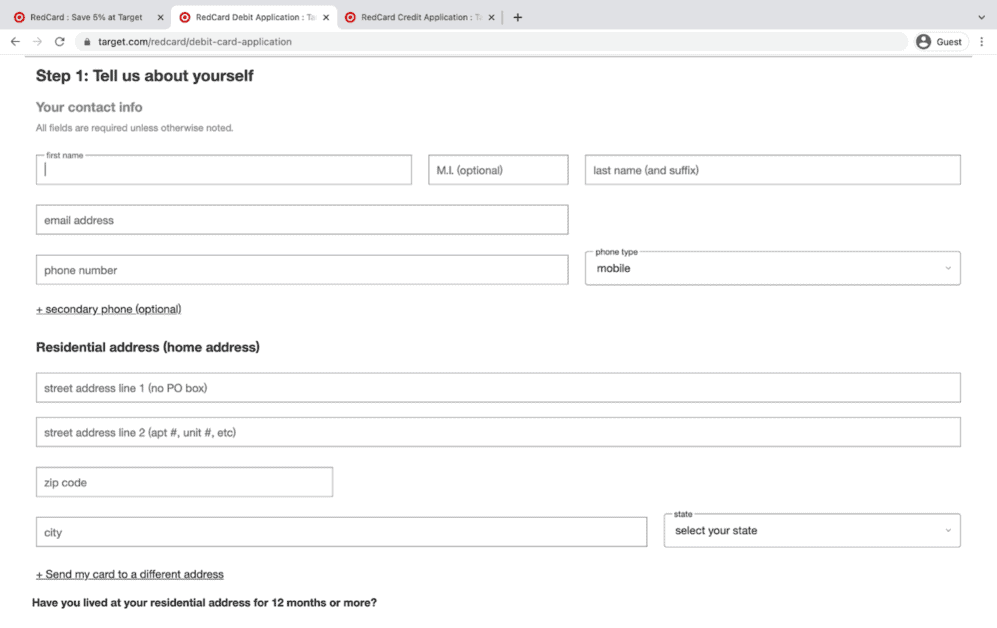

Here is a step-by-step guide to applying for a Target RedCard debit card:

1. Provide contact information. This includes your name, phone number, email address, and home address.

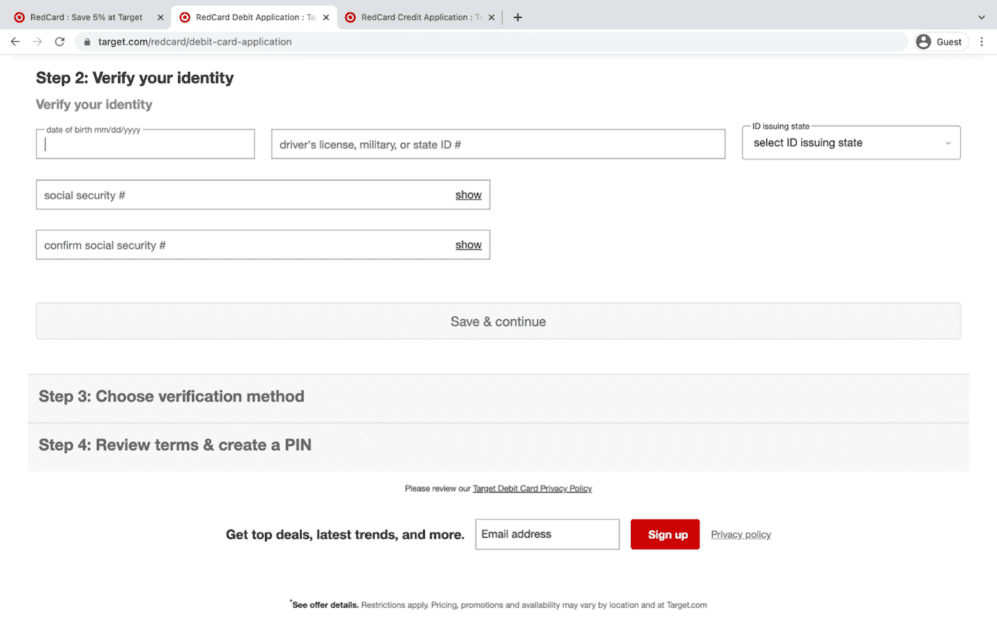

2. Verify your identity. Provide your birthday, ID information, and social security number.

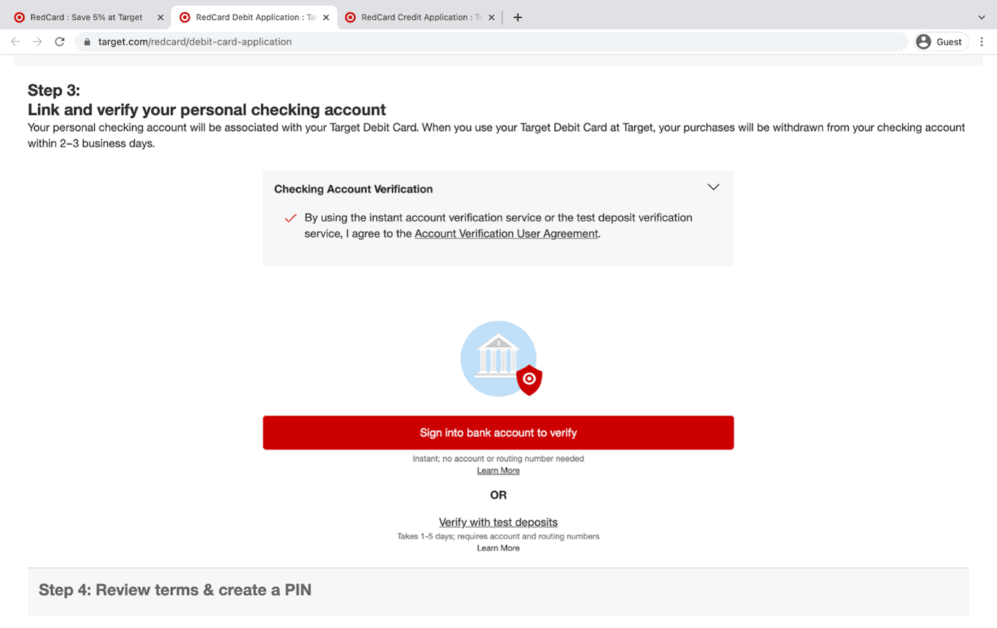

3. Verify your personal checking account. You can sign into your bank account to verify it immediately. You can also enter your account and routing numbers and wait for test deposits to verify.

4. Create a PIN.

5. Submit your application and wait for the approval.

Hi – Thanks for reaching out to us. If you have sign up in the store, Guest Services are able to print out a temporary slip for you to use. For any additional information please contact our REDcard Escalation Team 800.424.6888.

— AskTarget (@AskTarget) August 19, 2019

Can I Use Target RedCard Immediately?

You can use the Target RedCard immediately once your application is approved. Apply in-store to get instant access to your RedCard. For online applications, you need to wait a few days for approval. You can still use your RedCard before receiving the physical card by adding it to your Wallet in the Target app.

The Target RedCard is immediately accessible via your Wallet once you are approved. You can add the RedCard to your Target Wallet and pay for your purchase by scanning the barcode in the app.

The easiest way to have immediate access to your RedCard is by signing up in-store for a debit card. You will need to bring in a blank check and your ID to apply.

If you are immediately approved for a RedCard debit card, you will receive a temporary card that you can use until you receive your actual card in the mail.

If you sign up online, you may have to wait a few days for approval. There are a few ways to speed up the process, though.

When signing up for a RedCard debit card, sign in directly to your bank account instead of providing information for test deposits. This will allow instant verification of your checking account.

RedCard Credit cards are typically approved relatively quickly. At the beginning of your credit card application, you can select the option to automatically add the card to your Wallet once it is approved.

This will give you immediate access to the RedCard credit card via your Target Wallet, ideally in just a day or so.

For your security, we’re not able to assist with RedCard concerns here. Please visit https://t.co/Gla4QrXpdN and log in to Manage My RedCard to send a secure message to RedCard Guest Services or call Target RedCard 800.659.2396. Have a good day.

— AskTarget (@AskTarget) October 7, 2021

How to Manage the Target RedCard

You can manage your Target RedCard online or by calling RedCard Customer Service at 1-800-424-6888. To manage the card online, use the RedCard page on the Target website. If you call customer service, you will need to follow automated voice prompts to manage your RedCard.

Managing the Target RedCard online is simple. All you need to do is sign in to your RedCard account from the website. Then, you can make any necessary changes to your card.

If you prefer to manage your card by phone, you can call the Target RedCard customer service phone number. The number for credit card holders is 1-800-424-6888. The number for debit cardholders is 1-888-729-7331.

The first number (for credit cards) is also the main RedCard Guest Services number.

When you call one of these numbers, you will need to enter the last four digits of your card number.

You will also need the last four digits of your social security number (or another identification number). Then, you will be given various options for managing your card.

You can adjust your PIN or banking information from the phone. For example, debit cardholders can update their checking account information.

You can also hear about the recent transactions that have been made with your RedCard.

If you have lost your RedCard, or if someone has stolen it, you can also report this using the phone prompts.

Other options for managing your card on the phone include requesting a new card, updating your card info, and closing the card.

You can also call one of the numbers above and follow the voice prompts to learn more about your account benefits.

Finally, you will be given the option to speak with a team member when you call one of these numbers.

The Target team members can answer any questions you may have about your RedCard.

At this time, REDcards cannot be added to digital wallets like Apple Pay, Google Pay or Samsung Pay. However, adding the REDcard to your Wallet will simplify the check-out process. We’ll make sure to share your feedback further!

— AskTarget (@AskTarget) August 18, 2019

Can I Add Target RedCard to Apple Pay?

Unfortunately, you cannot add your Target RedCard to Apple Pay as it can only be used for purchases made at Target. In addition, the Target RedCard cannot be added to Google Pay or Samsung Pay. However, you can still use your phone by adding your RedCard to Target Wallet and scanning your barcode at checkout to pay with your RedCard.

Even though Target RedCard doesn’t work with mobile payments, you can still use your phone to pay with your RedCard through Target Wallet.

This is particularly helpful if you forget to bring your RedCard with you. You can still get your 5% discount if you have added the RedCard to your Target Wallet.

Here are step-by-step instructions on how to add your RedCard to Target Wallet and use it for payments:

1. Download and Sign in to the Target app.

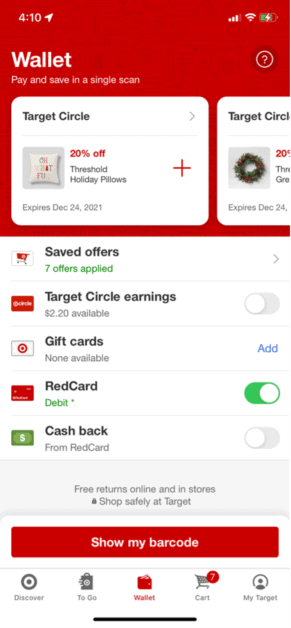

2. Select the “Wallet” tab from the navigation bar at the bottom of your screen.

3. Add your RedCard as a payment method. Click “Add payment” and then the “+” icon. Enter your RedCard information as prompted. Then, save the card to your Wallet.

4. Before paying, you will need to return to the Wallet tab and again click “Add payment.” Next, choose the RedCard to highlight it with a green box and save this selection. Now, your RedCard should be displayed as your payment method.

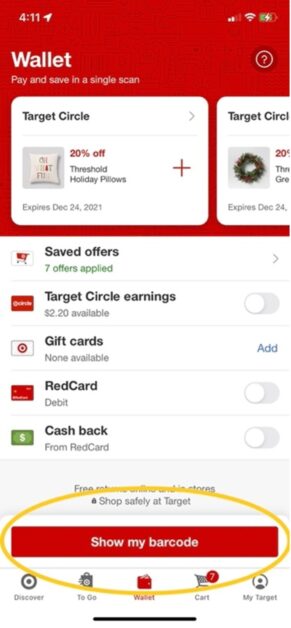

5. Ring up your items at checkout and scan the barcode within the Wallet tab (click “Show my barcode”). As long as you have not turned off the RedCard as your payment method, it will be used to pay for the transaction.

Of course, you can choose to use a different card with Apple Pay. If you are a member of Target Circle, you will still get your 1% cashback reward.

Using Apple Pay at Target is convenient if you can’t access your RedCard when making a purchase.

At this time, REDcards cannot be added to digital wallets like Apple Pay, Google Pay or Samsung Pay. However, adding the REDcard to your Wallet will simplify the check-out process. We’ll make sure to share your feedback further!

— AskTarget (@AskTarget) August 18, 2019

Can I Use My Target RedCard Without the Card?

You can use your Target RedCard without the physical card by scanning your barcode in the Target app. First, add the RedCard to your Target Wallet on the app or website. Then, access the barcode from the Wallet tab of the app. You will need to make sure the option to pay with your RedCard is toggled on before purchasing.

The Target app makes it easy to pay with your RedCard without a physical card.

As a cardholder, you can add the RedCard to your Target account online by following the prompts and entering the PIN.

Then, you can access the card by signing into the Target app or the website while shopping.

Once you enter the RedCard as a payment method, you can use it for Target online orders in addition to in-store purchases.

Keep in mind that you cannot save your Target Wallet barcode by taking a screenshot or printing it ahead of time.

The barcode will be changed a few minutes after you access it to protect your account.

Therefore, you must have access to your mobile phone when checking out at Target if you don’t have your RedCard with you.

Great question! Target Circle users do not accumulate the 1% earnings when using a Target RedCard, however you may still receive promotional offers within your Target Circle offers section. Thanks for reaching out! 😊

— AskTarget (@AskTarget) December 2, 2020

Can I Use Target RedCard and Target Circle Together?

You can use the Target RedCard and Target Circle together by connecting your RedCard to your Target Circle account. Since the RedCard offers a 5% discount, the 1% Target Circle rewards are not earned on purchases paid with a RedCard. All other Target Circle benefits still apply to the purchase.

It is recommended that you enroll in Target Circle if you have a Target RedCard.

Even though you won’t get the 1% rewards on purchases made with a RedCard, you can still take advantage of the other deals and benefits.

You must connect your Target RedCard to your Target Circle account for all these benefits to work.

RedCard holders with a Target Circle account can save on the many discounts offered to Circle members.

They are also eligible for bonus offers for Circle members. It’s easy to apply the Target Circle discounts and pay all at once by scanning the barcode in the Wallet at checkout.

Additionally, Target RedCard holders can earn votes for Target’s community giving when they shop. Each quarter, Target donates a set amount of funds to local organizations.

Target Circle members help decide how these funds are distributed by voting after making purchases.

Here is one more reason to sign up for Target Circle along with your RedCard: You can earn the 1% reward any time you do not have your RedCard to pay with.

Whether you forgot your card at home or didn’t want to pay with your RedCard, you can still earn the 1% cash back rewards.

This can help you save a little extra money when you aren’t able to get that 5% discount from the RedCard.

Conclusion

The Target RedCard is a great way to save money. You can sign up for either a credit card or a debit card and start earning 5% discounts on purchases as early as the same day you sign up.

So if you’re a frequent Target shopper, check out the RedCard options to see how you can benefit from this program!

If you’re interested in finding out more tips about shopping at Target, check out the related articles below.

Related Articles:

Target Hours, Markdown Clearance Schedule, and Best Time to Shop

Target Gift Cards: Where to Buy and How to Use Them

Target Circle: How It Works and How to Use It In-Store and Online

Target Curbside Pickup: How to Order Groceries Using Drive Up